Effects of energy transition and the structural change on the extraction of natural resources in Germany

Latest Update: September 2023

Climate change sets tremendous challenges for actors globally in the fields of politics, industry and civil society. In view of international and national plans to reduce emissions of greenhouse gases that are harmful to the climate, the extractive sector must make an important contribution to achieving the target of climate neutrality. The energy transition will have a considerable influence on the demand for and sale of coal, oil and gas and will start or accelerate a structural change in these industries. Parallel to this, natural resources for climate-neutral technologies, renewable energy, electrical mobility and hydrogen are seeing increasing demand.

The Federal Republic of Germany is bound by various international benchmarks to cope with climate change. In the Paris Agreement of 2015 the world community came to a legally binding agreement for the first time to limit global warming as far as possible to 1.5° Celsius compared to temperatures in pre-industrial times. The European Union has also set specific targets with the European Green Deal (“European Climate Law”). The element at the core of all agreements is a massive reduction in greenhouse gases.

In order to meet these obligations, Germany is pursuing a national climate policy that has resulted in a series of laws being passed over recent years. The German Federal Climate Protection Act of 2019 and 2021 1 sets specific annual reduction targets for greenhouse gas emissions and has set the objective of being climate neutral 2 by 2045. The “German Coal Phase-Out Act” 3 of 2020 governs the ending of coal mining and coal-fired generation by 2038.

At the start of 2021, Germany set up its own national emissions trading system to put a price on fossil greenhouse gas emissions to run alongside the European emissions trading scheme that has been in existence since 2003.

This section takes a closer look at some of the laws that apply in Germany for improving climate protection, the status of renewable energies and the rise in demand for metal and mineral natural resources.

Activities and measures are also described that have been undertaken in Germany to tackle the challenges of the energy transition and structural change in relation to the extraction of natural resources.

Legal base

German Federal Climate Protection Act

The German Federal Climate Protection Act, a new law introduced in 2019, sets the legal framework for climate policy in Germany. It sets out German climate targets in law and includes a mechanism for monitoring and adjustment to meet the climate protection targets.

On 24 June 2021 the German Bundestag passed new and ambitious climate protection targets with the amendment to the German Federal Climate Protection Act (in force since 31 August 2021) with the aim of achieving net greenhouse gas neutrality in Germany by 2045. As interim targets, greenhouse gas emissions are supposed to be reduced by at least 65% by 2030 based on 1990 levels and by a minimum of 88% by 2040. In addition, it is intended that the land use, land use change and forestry (LULUCF) sector will gradually become a reliable carbon sink for 25 million tonnes a year by 2030 and 35 million tonnes of CO2 equivalents by 2045.On the way to 2030 the German Federal Climate Protection Act specifies permissible annual emission levels for the energy, industry, building, transport, agriculture and waste management sectors. In the course of the amendment, the trajectory for reducing emissions in these sectors has been made more stringent. The energy and industry sectors are being required to shoulder most of the additional reductions.

The German Federal Climate Protection Act provides for a checking and adjustment mechanism for complying with the permissible annual emission levels. On 15 March each year, the German Federal Environment Agency publishes the emissions data on the previous year’s greenhouse gas emissions. These are checked by the expert council for climate issues. If a sector exceeds the annual emission level, the department largely responsible for the relevant sector must submit an emergency programme to balance out the emission level that has been exceeded and ensure that the emission levels in the subsequent years will be complied with. The Federal Government then decides on the measures to be taken in the relevant sector or in other sectors concerned or on cross-sector measures.

The building sector and the transport sector exceeded the annual emission levels permitted in the Federal Climate Protection Act by 2 million tonnes and 3 million tonnes CO2 equivalents respectively in 2021. In accordance with the requirements of the Federal Climate Protection Act, the departments responsible for the building sector, the Federal Ministry for Housing, Urban Development and Building and the Federal Ministry for Economic Affairs and Climate Action, submitted an emergency programme in the building sector on 13 July 2022. The Federal Ministry of Digital and Transport also presented an emergency programme for the transport sector on 13 July 2022.

The respective annual emission levels for 2021 in all other sectors fell below the threshold.

In July 2022, the German parliament launched a comprehensive package of measures to improve planning and approval procedures for onshore wind energy. For example, the Renewable Energy Act stipulates that the use of renewable energies is in the overriding public interest and serves public safety. Furthermore, the “Act to Increase and Accelerate the Expansion of onshore Wind Turbines” was passed as a central building block in the further acceleration of the expansion of onshore wind energy. This act amends the Wind Energy Area Requirements Act (WindBG) and the Building Code, among other things. The main content of this act is the legal implementation of the coalition agreement that provides for 2-percent of the area of Germany being reserved for onshore wind energy. In addition, the amendments to the Federal Nature Conservation Act standardised and simplified the species protection assessment of onshore wind turbines in the approval procedure.

National Allowance Trading for Fuel Emissions

Europe-wide CO2 pricing has already existed for the energy sector, energy-intensive industries and internal European air transport since 2005 with the European emissions trading system. The areas of heating and transport have not been covered to date. This changed on 1 January 2021 with the introduction of national fuel emissions trading in accordance with the Fuel Emission Trading Act (BEHG). BEHG requires companies that distribute fuels (heating and fuels) to acquire emissions allowances and to submit these by 30 September of the following year. The costs are passed on in the usual way along the supply chain. The CO2 price has the effect of steering the choices of end users, as the rising prices make climate-friendly alternatives increasingly attractive.

The legislator has planned a fixed-price system for the introductory phase. The aim is that citizens and business can gradually adjust to the CO2 price when provided with a rising but reliable price trajectory. Parallel to this, a trading platform is being established which allows certificates to be auctioned and trading. Whereas one emissions certificate cost €25 in 2021, companies will have to pay €55 per certificate as early as 2025. From 2026 it is intended that the certificate price will always be formed by the market, although a price corridor of €55 to €65 per emissions certificate is planned for 2026. On 3 September 2022, as part of the Federal Government’s package of measures to secure an affordable energy supply and strengthen incomes, the coalition committee decided on a CO2 price relief from 1 January 2023, for the purpose of which the CO2 path under the BEHG is to be adjusted before the end of 2022.

The intention is as far as possible to balance out situations where national fuel emissions trading results in competitive disadvantages for German companies (called carbon leakage). The BECV (ordinance on measures to avoid carbon leakage through national fuel emissions trading) adopted by the Federal Government provides relief for companies affected and entitled to state aid in the form of financial compensation but in exchange it requires them to invest in climate change mitigation measures.

From 1 January 2023, the financing of renewable energies will be completely changed. The EEG levy will be permanently abolished with the Energy Financing Act and the financing needs of renewable energies will be covered by payments from the Federal Government from the Climate and Transformation Fund (KTF). This results in a lower electricity price for both citizens and industry. The long-distance commuter allowance will be raised from part of the revenue (initially planned from 2024, brought forward to the period 2022 to 2026 by the Tax Relief Act 2022 (Federal Official Gazette I p.749). The aim is to design fuel emissions trading to include social responsibility as a result of this and further measures such as increasing housing benefit.

German Coal Phase-Out Act

The Act to Reduce and End Coal-Fired Power Generation and Amend further Laws (Coal Phase-Out Act) came into force on 14 August 2020 4. The Coal Phase-Out Act is a so-called article or shell law, i.e. a law that enacts or amends several laws at the same time, including sometimes different areas of law. The key regulations for the German coal phase-out can be found in the Act to Reduce and End Coal-Fired Power Generation (KVBG) as part of the Coal Phase-out Act. The adoption of the Coal Phase-out Act was complemented by amendments to further energy industry regulations – such as the Energy Industry Act, the Energy Act, the Greenhouse Gas Emissions Trading Act, the Renewable Energy Act, the Combined Heat and Power Act, etc. The KVBG aims to gradually reduce coal-fired electricity generation in Germany as steadily as possible and in a socially responsible way, ending it by 2038 at the latest. This will result in reduced emissions. The aim is to continue to provide a reliable, cost-effective, efficient, low-carbon supply of electricity to the general public. The legislative package contains regulations to reduce and end electricity generation using hard coal and lignite, to continuously check security of supply, to cancel any CO2 certificates that become free, authorisation to provide compensation for electricity users in the event that the electricity price increases as a result of phasing out coal and adaptation payments for older employees in the coal sector (see chapter 6). In order to compensate for the falling coal-fired power generation, the target is to expand renewable energy to 65% in 2030. In addition to this, support for combined heat and power is being extended to promote the changeover to flexible and greener electricity supplies. 5

Electricity generation using hard coal will be reduced between 2020 and 2026, initially in stages through competitive tendering for hard coal plants involved in the electricity market. In the tender procedure the plant operators state a bid price at which they are willing to cease using coal to power their plant. By participating in the competitive process, plant opera- tors receive appropriate financial compensation for phasing out hard coal. Small lignite plants up to 150 megawatts (MW) can take part in the tender proce- dures as well. The target data in 2022 (in each case 15 Gigawatt (GW) of hard coal and lignite), 2030 (8 GW hard coal, 9 GW lignite) and 2038 (zero GW) is to be achieved through this. Through this process the pos- sible maximum price per reduced MW falls from EUR165,000/MW (2020) to EUR89,000/MW (2026). Should the reduction targets set by law for hard coal capacities not be achieved, the tender from 2024 on- wards will be backed up by regulatory frameworks. From 2027 closures of hard coal workings will be exclusively on the basis of regulatory frameworks.

On 25 November 2020 the European Union gave its approval under state aid rules with regard to the legal arrangements to reduce and end electricity generation using hard coal. 6 To reduce and end electricity generation in Germany from lignite, the KVBG specifies a binding plan to shut down lignite workings. It includes, among other things, binding data on shutting down the mines and arrangements for compensating the operators of the closed lignite mines. According to this, RWE receives €2.6 billion and LEAG receives €1.75 billion. 7 The statutory regulations are supported by a contract under public law 8 in that lignite operators undertake – among other rules – to close all power plants and also to do so in a socially responsible way. The time when the individual lignite power plants will close is spread out between 2020 and 2038 as set out in Annex 2 of the Act to End Coal-Fired Power Generation, (KVBG). The contract also contains arrangements stipulating how to use the compensation payments to cover the follow-on costs of opencast mining and to safeguard these as well as comprehensive waiving of legal remedies by operators of lignite plants. In the Lausitz coalfield, the compensation payments are paid to special purpose vehicles that were set up in the course of precautionary agreements between the lignite operator and the Federal State of Brandenburg and Saxony (see chapter 7.1). From 2025 onwards, the annual compensation instalments attributable to the respective special purpose entity are to be paid into the special purpose entities by the Federal Government. LEAG’s payments in the years 2021 to 2024 can already be partially reimbursed by the Federal Government.

The European Commission checks the appropriateness of the compensation payments to the operators of lignite power plants and their special purpose vehicles in a main examination proceeding under state aid legislation. These proceedings were opened on 7 May 2021. The purpose of the proceeding is to obtain greater legal certainty for all those involved. Examination by the European Commission does not suspend in any way the implementation of the agreed trajectory for shutting down the power plants. The European Commission has jurisdiction over the proceedings.

In 2019, Lausitz Energie Bergbau AG established the special purpose vehicles named above in Brandenburg and Saxony – “Lausitz Energie Vorsorge- und Entwicklungsgesellschaft Brandenburg mbH” (LEVEB) 9 and “Lausitz Energie Vorsorge- und Entwicklungsgesellschaft Sachsen mbH” (LEVES). 10

All the shares in LEVEB were pledged to the State of Brandenburg on 12 December 2019. According to its own information, Lausitz Energie Bergbau AG (LEAG) contributed the full base amount of €102.9 million to LEVEB as of 30 June 2021. 11

The payments to the Saxon company LEVES planned for the years 2019 to 2021 have been made as scheduled. According to its own information, Lausitz Energie Bergbau AG (LEAG) contributed the full base amount of €110.7 million to LEVES as of 30 June 2021. 12 The pledge of company shares to the Free State of Saxony made in January 2020 remains in place.

Structural Strengthening Act

The end of coal-fired power generation also means the end of coal mining in Germany. Whereas hard coal mining finished in Germany on 31 December 2018 (see chapter 6) and the power plants using hard coal that still exist operate with imported coal, lignite power plants are exclusively operated using domestically mined lignite. According to the plan to shut down mines set out in the Coal Phase-Out Act, this mining will be reduced and will have finished by 2038. In order to mitigate the consequences of phasing out coal-fired electricity generation and to encourage economic growth in the regions affected by the phasing out of coal, the Structural Strengthening of Coal Regions Act (Structural Strengthening Act) 13 came into force at the same time as the Coal Phase-Out Act was passed. To support structural change, until 2038 the lignite regions are receiving financial help of up to €14 billion for especially significant investments by the Federal States and municipalities. In addition, the Federal Government supports the regions through further measures under its own responsibility with up to €26 billion until 2038.

Furthermore, structurally weak regions with hard coal-fired power plants where hard coal has a great economic significance receive up to €1 billion of additional support.

Renewable energies

Renewable energies in Germany

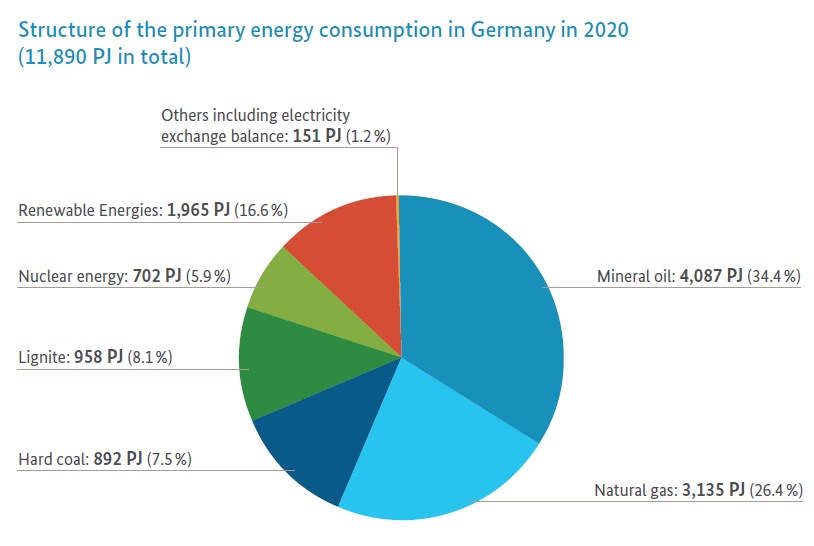

Renewable energies 14 make a large and growing contribution to Germany’s energy supply. In 2020, the share of renewable energies amounted to 16.6 % of total primary energy.

The proportion in the electricity sector is especially high. 45.3% of gross electricity consumption is covered by renewable sources (250,157 GWh). The Federal Government has set itself the goal of increasing the share of electricity produced by renewable energy at 80% in 2030 and to almost completely decarbonise the energy supply by 2050 and thus to reduce greenhouse gas emissions. In 2020 around 83.9 % of greenhouse gas emissions (601.7 Mt CO2 equivalents) could be attributed to the combustion of fossil energies.

Source: Working Group on Energy Balances April 2022 and AGEE-Stat. of February 2022. For detailed source information see final note viii.

Fossil-fuelled power plants are currently needed (in addition to renewable energies) to meet energy requirements in Germany. The technologies of renewable energy plants require steel, cement or petrochemical raw materials as the following example shows: The components of a wind turbine consist of roughly 45% crude oil and petrochemical industry products. One wind turbine blade can be 30 to 50 metres long in large wind turbines and it contains up to 12 tonnes of petrochemical products.

Some of the metals required for the energy transition (e.g. indium, germanium and gallium) are additional natural resources, i.e. they are obtained as by-products during the extraction of a different metal. In the case of these metals, the regulatory mechanisms for the supply of natural resources only function to a limited extent. In Germany and Europe, potential deposits like this do exist, with the result that import dependencies could be reduced through the targeted development of these deposits, corresponding investments and the extraction of their natural resources.

In 2020, investments in renewable energies amounted to €11 billion, while the operation of the existing plants generated €18.3 billion in sales. The expansion of renewable energies can create a large number of new jobs due to the increasing demand for electricity and heat and the goods and services produced with renewable energy. In 2020, the renewable energy sector overall produced employment for more than 338,000 people. Here the focus was on renewable energy in electricity generation. The expansion of renewable energies is financed by feed-in tariffs which are higher than the stock exchange electricity price. The difference in costs between the stock exchange electricity price and remuneration for the electricity from renewable energy plants (EEG) are paid for by electricity consumers as part of the price they pay for electricity via the EEG levy. In 2020, the EEG levy amounted to 6.756 ct/kWh for consumers who are not exempt in part or even in full from the levy, such as some major industrial consumers.

Since 2021 the EEG levy is reduced by a subsidy from the Federal Government. In addition to revenue from the new national CO2 pricing for heating and motor fuels for transport and heating, a further €11 billion was given to the EEG levy from the economic stimulus package.

As a result, a sharp increase in the EEG levy following the corona pandemic was avoided. The levy will receive increasing income from the CO2 pricing and possible remaining funds from the economic stimulus package and the intention is to reduce the levy further in the future. This will give relief to electricity users and at the same time provide incentives for an energy transition across sectors. If renewable energies are to expand further, industrial energy projects must be suitably combined with the development of the renewable energies. This also applies to the German natural resources industry, which has already established a series of wind, biomass, geothermal, solar and hydroelectric power projects in Germany.

Renewable energy sources are used in electricity and heat generation and in the transport sector. The most important renewable energy source in the electricity sector is wind power: In 2020, more than half (52.8%) of electricity was generated from wind energy. Wind energy plays a vital role in the expansion of renewable energies, an expansion which will ultimately result in an economically-viable and climate-friendly energy supply at reasonable prices and with a high level of general prosperity. In 2020, the use of wind energy accounted for 23.9% of German electricity consumption. Wind turbines have been built on various closed mine sites, mainly on now-green colliery slag heaps on which favourable wind conditions exist. In addition to the further development of suitable land sites and the replacement of older, smaller wind turbines by modern and more powerful models – so-called “repowering” – the expansion of wind energy at sea is also becoming increasingly important. During the period 2017 to 2020 alone, wind energy turbines were installed with a capacity of around 1,200 MW on land and roughly 220 MW at sea. Wind turbines with a total capacity of around 62,188 MW were operating in Germany in 2020; they produced around 132,000 G GWh of electricity in 2020, one fifth of which was generated by wind turbines at sea. The Federal Government is planning to have an offshore wind power of 30,000 MW on the grid by the year 2030 and 115,000 MW of wind energy on land. In view of this expansion and the ever-larger power units (more than 10 MW per offshore wind turbine), the need for mineral natural resources will also increase. Concrete, for example, is required for the construction of wind turbine foundations. This also means a correspondingly higher demand for limestone for cement production and for aggregates such as gravel and sand.

Biomass has become a very relevant energy source for electricity generation. Bioenergy for producing electricity is supposed to remain at the current level in view of the competition to use the land to grow food and fodder or generate energy. The total capacity of biomass electricity generation plants is around 10,433 MW, electricity generation in 2020 amounted to more than 50,900 GWh (9.2% of the total electricity consumption, 20.3% of the renewable electricity generation). In addition to biogas (including biomethane and landfill and sewage gas), solid and liquid biomasses and biogenic waste are also used to generate electricity, but biogas is the most important single biogenic energy source for electricity generation with 57% (2020) of the entire biomass.

Another renewable energy source with great potential is solar electricity generation. More than 2 million photovoltaic plants convert the sun’s radiation energy directly into electricity – these plants represented a total of around 53,700 MW of installed capacity in Germany at the end of 2020, and around 4,800 MW of power were added in the same year. Electricity generation from photovoltaics continues to rise steadily as a result, attaining approximately 48,500 GWh in 2020. Photovoltaics thus accounted for 8.98% of total electricity consumption and contributed 19.7% of renewable electricity. German mining companies are also increasingly opting for the use of photovoltaic systems at various mining sites in Germany. By 2030, the total installed capacity for the use of solar radiation energy in Germany is expected to be 215,000 MW.

In addition to wind, biomass and photovoltaics, hydropower also contributed to electricity generation with around 18,300 GWh in 2020.

Renewable energy sources are also increasingly being used in the heating sector. In 2020, a total of 181,700 GWh was produced by renewable heat sources. The most important renewable energy sources for heat generation are biogenic solids with around 117,100 GWh, produced mainly by wood in the form of e.g. wood pellets. Biogas, biogenic waste and geothermal energy and heat harnessed by heat pumps are also relevant renewable heat sources, each of which generated heat of approx. 14,000 to 16,000 Gwh in 2020. Solar thermal energy also contributed to the supply of heat with around 8,900 GWh. Deep geothermal energy is a base-load-capable form of energy, which makes up a very small but fixed element of electricity and heat generation. In general, the great potential of geothermal energy is not exploited in Germany. 15 Apart from producing energy, deep geothermal reserves potentially have a material use such as for the extraction of lithium from the extracted brine. With this in mind, the use of brine can improve the cost effectiveness of geothermal projects, in particular in the Upper Rhine Plain and in the North German Basin. Here there is considerable need for research, even though pilot projects already exist. 16

In the transport sector, biomass can reduce CO2 emissions, especially in the form of biofuels such as bioethanol, biodiesel and biogas for cars, trucks, trains, ships and aircraft. Electric vehicles are another option for reducing CO2 emissions. In 2020, renewable energies accounted for 7.6% of fuel consumption in Germany.

Thanks to its flexible use in the electricity, heating and transport sectors, biomass is the most important renewable energy source. In 2020, 51% of total final energy from renewable energy sources was provided by the various types of biomass used for energy purposes.

The expansion and use of renewable energies helps to avoid greenhouse gas emissions and reduces the use of fossil energy sources. The savings also reduce the proportion of imports of mineral oil, natural gas and hard coal required. Despite the expansion of renewable energies, conventional power plants are still needed to meet energy requirements.

Study of the demand for natural resources in the field of renewable energies

In the course of producing the second D-EITI report the MSG commissioned a study on the effects of renewable energies on future natural resource requirements and the associated socio-economic implications. The Prognos Institute, commissioned to produce this report as an external service provider, prepared the study entitled “Raw material requirements in the field of renewable energies” (2019) and submitted it to the MSG. The complete study is available here. 17

However, the study did not deal with the extent to which the future demand for base and technology metals for renewable energy plants can be met by the mining of natural resources in Germany. Information on the deposits, extraction and requirement for these natural resources in Germany can be found in the reports of the Federal Institute for Geosciences and Natural Resources (BGR) and The German Mineral Resources Agency (DERA):

- BGR (2017). Domestic mineral resources – indispensable for Germany! (Heimische mineralische Rohstoffe – unverzichtbar für Deutschland!)18

- BGR (2021). Germany – Natural Resources Situation 202019.

- Marscheider-Weidemann, F. et al. (2021). Natural resources for future technologies 2021.20

The following sections are taken from the summary of the study. The MSG is neither responsible for the con- tent of the study nor for the contents reproduced here and does not adopt them as its own.

Classification of the renewable energies in Germany’s energy supply and presentation of the natural resources requirements for EE plants

“[…] The conversion of the energy supply to renewable energy sources creates an additional demand for natural resources, while the demand for fossil resources is declining. The analysis of the natural resource requirements carried out in the report relates both to energy conversion plants (wind power and photovoltaics) and to significant technological changes in the use of energy sources (stationary storage facilities and batteries for electric mobility). The study examined construction raw materials, base metals and technology metals. The estimation of the natural resource requirements is carried out until 2030. The estimations are based on a future development of the energy system in Germany according to scenario B of the German grid development plan 2019 of the German transmission grid operators. 21 This scenario shows a possible development path of the energy system taking into account the political objectives, i. e. in particular to achieve a share of renewable energies in gross electricity consumption of 65 %”.

In the case of construction raw materials, raw materials for concrete production play a significant role. In 2018, the demand for concrete used for newly installed wind turbines amounted to 1.8 million tonnes. The average annual demand is expected to remain constant at around this level in the future. However, the demand for construction raw materials caused by the energy transition is rather low compared to the demand in residential and road construction (Germany had a demand for ready-mix concrete of around 115 million tonnes in 2018).

Important base metals for the energy transition are steel and aluminium as well as copper and nickel. Steel is used in many plants as a building material. The demand for steel caused by the energy transition is of secondary importance compared to the overall demand for steel in Germany. Aluminium is widely used in wind turbines and car components. The expansion of electromobility is expected to result in an additional annual demand for aluminium of around 162,000 tonnes in 2030. In addition to wind power and PV systems, copper is also used in electric mobility. Copper is likely to experience significant demand impulses as a result of the energy transition. While the copper demand for wind power and PV plants was 11,200 tonnes in 2013, the annual copper demand will increase by an additional 73,500 tonnes for batteries, electric motors and power electronics by 2030. The demand for nickel for electromobility is estimated to be around 1,050 tonnes in 2016. A ramp-up to around 1 million newly registered electric vehicles in 2030 would result in a nickel requirement of around 56,000 tonnes.

In connection with the energy transition, the technology metals gallium, indium, selenium and silicon are of relevance due to their use in PV modules. The same applies to cobalt and lithium due to their use in lithium-ion batteries and to neodymium and dysprosium due to their use in wind turbines and electric motors. The future annual demand for technology metals for the production of PV modules will remain more or less constant. The annual demand for cobalt and lithium is rising significantly due to increasing battery sales. The same applies to the demand for the rare earth metals neodymium and dysprosium. This is in particular due to the increase in electromobility and to a lesser share due to the construction of wind turbines. Table 1 provides an overview of the future demand for technology metals for key technologies of the energy transition.

The primary extraction of some of the raw materials required, e. g. cobalt, can be associated with high human rights, social and ecological risks, especially in countries with weak governance structures. In artisanal mining, child labour and a lack of social and safety standards can go hand in hand, which can also lead to health problems for the local population. Environmental pollution from the extraction of primary raw materials is also caused, for example, by deforestation (e. g. bauxite extraction), water evaporation (e.g. lithium extraction from salt lakes) and dam fractures (risk at mining sites).

Demand for technology metals for key technologies of the energy transition according to scenario B 2030

Socio-economic significance of renewable energies

In 1990, the Electricity Feed-in Act (Stromeinspeisungsgesetz) introduced a subsidy mechanism to initiate the transformation of the energy system. For the first time, energy supply companies in Germany were obliged to purchase electrical energy from renewable generation processes (wind- and hydropower as well as solar energy and biomass). Today, the use of renewable energies in Germany is largely promoted financially by the Renewable Energy Act (EEG). The EEG introduced a levy on electricity consumption (with the exception of energy-intensive commercial consumers) in addition to the electricity price. The EEG levy for 2019 was 6.4 ct/kWh. The expected levy for 2019 amounted to €23 billion.

Employment in the lead market “environmentally friendly energy generation, transport and storage” amounted to 284,000 full person equivalents in 2018. The number of direct and induced jobs is subject to fluctuations and stood at 338,500 in 2016. Fluctuations in employment can be attributed among other things to fluctuations in the production of renewable energy plants and fluctuations in the number of plants installed in Germany.

A declared goal of the federal government is to increase the share of gross electricity consumption from renewable energy sources to 65 %. Currently, the share of renewable energies in gross electricity consumption is approx. 38 %. In order to achieve the targeted share, the installed capacity must be increased accordingly from 2018 to 2030. These expansion targets face numerous challenges in the development of renewable resources. Challenges exist with regard to the designation of suitable areas and securing social acceptance.

The report then illustrates the socio-economic significance of renewable energies based on a regional analysis taking into account the different potential for use of of each energy source or technology used. The following three German regions will be presented: A North German wind region (consisting of the Federal States of Schleswig-Holstein, Mecklenburg-Western Pomerania and Lower Saxony) with a focus on wind energy, a Central German region (Hesse, Saxony-Anhalt and Thuringia) with bioenergy use, and a South-East German solar region (Baden-Wuerttemberg, Bavaria and Brandenburg), where solar energy plays a major role.

In 2017, 8,100 companies and 50,000 employees were active in the field of renewable energies in the wind region of Northern Germany. The gross value added in 2018 was about €5 billion. In the wind energy sector, around 4,000 companies and around 17,900 people were employed in 2018, which is roughly double the figure for 2010. Despite the strong growth to date, fluctuations are to be expected regarding future developments. For example, if the expansion of wind power plants stagnates, employment is expected to fall.

In 2017, 5,900 companies and around 37,000 employees were active in the renewable energy sector in the central German bioenergy region. The gross value added in 2018 was about €4.5 billion. In the field of bioenergy, around 2,000 companies with around 7,600 employees were active in 2018, which corresponds to a slight increase from 5,100 employees in the industry in 2010. The largest increase took place in the area of operation and maintenance.

In 2017, 16,700 companies and almost 100,000 employees were active in the field of renewable energies in the South-East German solar region. The gross value added in 2018 was about €11 billion. In the field of solar energy, around 5,500 companies with around 20,100 employees were active in 2018, which corresponds to less than half of the 2010 active workforce in the sector. The reasons for the decline in employment and value added include the relocation of plant production abroad and a decline in the installation of new plants compared with the high installation figures during the years 2010 to 2012.

The expansion of renewable energies also faces challenges. These include issues of volatility and security of supply as well as social acceptance of capacity expansion. While the majority are generally in favour of expansion, this support varies depending on the type of technology and appears to be decreasing depending on the degree of direct impact. Questions of nature and species conservation as well as noise and odour emissions also lead to acceptance problems.

Domestic natural resources for future technologies

The extraction of domestic natural resources plays a key role in the reliable and sustainable supply of natural resources in Germany and it can reduce dependence on imports. Technologies to mitigate climate change and projects such as the energy transition, electromobility and digitalisation will change the need for raw materials and in particular the need for natural resources such as lithium, rare earths, cobalt, nickel and copper.This is a good reason to take a closer look at promoting domestic natural resources for future technologies in Germany. For instance, it is possible in principle to extract lithium from deposits in Germany. The European Commission has put lithium as well as tungsten, gallium, indium and cobalt among others on the list of “critical natural resources”. These include natural resources that have crucial economic importance but, because only small quantities if any are extracted in the EU, largely have to be imported. The extraction of individual critical natural resource involves potential environmental risks in some third countries. Domestic extraction of these natural resources classed as “critical” 22 in accordance with the highest environmental and social standards can make a certain contribution to sustainable, integrated European value chains.

Projects to extract lithium in Germany

Lithium-ion batteries are very light but deliver a high performance and thus make them useful for a wide range of applications such as in smartphones, tablets and electric vehicles. To date, all the lithium required for this has been imported. However, deposits of lithium are also available in Germany, e. g. in the Ore Mountains near Zinnwald (Saxony), Falkenhain and Sadisdorf, and in the Upper Rhine Plain (Baden-Wuerttemberg, Rhineland-Palatinate and Hesse), dissolved in thermal waters. Projects to extract lithium are currently being implemented in these areas.

On the subject of reducing dependence on imports, apart from recycling the Federal Government is advocating a natural resources strategy that involves local extraction of natural resources for future technologies, which also includes lithium.23

In its current publication “Rohstoffrisikobewertung Lithium” 24(“Natural resources risk assessment for lithium“), The German Mineral Resources Agency (DERA) in the BGR cites two planned projects to extract lithium in Germany. One project in Zinnwald (Saxony) is operated by the company Deutsche Lithium and another is in Sadisdorf (Sachsen) with the company Tin International. 25 Since October 2021 the BGR is coordinating a project with a research network involving different players to examine the potential for lithium in Germany.26 Initial results for the project are expected in 2022. An overview of the proven geological reserves of lithium and further metals and minerals in Saxony compared to worldwide reserves and global production can be found in the Natural Resources Strategy for Saxony (“Rohstoffstrategie für Sachsen”).27

The deposits of lithium in the thermal water of the Upper Rhine Plain could be extracted in an environmentally friendly way from deep water in geothermal plants using new, cost-efficient processes. Appropriate processes are currently being trialled.

It could be possible to cover a significant part of Germany’s lithium needs from domestic extraction. Apart from sustainable extraction, domestic production can also create integrated value chains in Germany and jobs.

Environmental protection, renaturation and recultivation

Energy transition involving the phasing out of coal-fired generation requires the end of lignite mining by 2038 at the latest according to the current legal position. As a result of this, mine operators in the coalfields of the Rhineland, central Germany and Lausitz have to comply with more stringent requirements to satisfy renaturation and recultivation obligations because of the extensive adaptations caused by bringing forward the end of mining lignite.

You will find more detailed information on general measures for environmental protection, renaturation and recultivation in chapter 7.2 of this report.

Social factors in relation to the structural change in lignite regions

One of the aims of the Structural Strengthening Act (StStG, also see section a.iv) is to provide support to achieve the goal of structural change in the lignite regions and to encourage the creation of new economic structures. A large number of measures are planned for the period 2020 to 2038 during which support payments will be made.

The second pillar is financial help from the Federal Government for projects of the Federal States. A total of up to €14 billion is available for this purpose, with which investments in the lignite mining areas can be subsidised by up to 90%. Opportunities for deployment are wide-ranging and cover areas such as development of infrastructure that is relevant to the private sector, tourism projects, digitalisation, urban and regional development and measures for climate and environmental protection.

In the so-called second pillar, measures are funded that fall under the sole responsibility of the Federal Government. An amount of up to €26 billion is earmarked for these measures. They will cover areas such as improving transport routes to the mining regions, different research projects and centres, and relocation of government institutions.

These investments are supplemented by the STARK German Federal programme, which supports non-investment projects of Federal States and municipalities. A wide range of funding areas is covered. For example, STARK can finance the operation of structural development companies or technology transfer projects.

1 Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection (BMUV) (2022): German Federal Climate Protection Act URL: https://www.bmuv.de/pressemitteilung/novelle-des-klimaschutzgesetzes-beschreibt-verbindlichen-pfad-zur-klimaneutralitaet-2045/ [Accessed on 9 December 2022].

2 Climate neutrality or greenhouse gas neutrality (which is a more precise term for what is generally called climate neutrality) means no longer changing the atmosphere and thus the earth’s climate system after a certain point as a result of emitting greenhouse gases. To achieve this, either the emission of greenhouse gases is reduced as a result of largely avoiding products and actions that will produce high emissions or greenhouse gases already emitted will be removed from the atmosphere through compensating projects. These include, for example, the selective extension of natural ecosystems that absorb CO2 (forests or peat bogs).

3 German Coal Phase-Out Act (KohleAusG). URL: https://www.gesetze-im-internet.de/kohleausg/BJNR181800020.html [Accessed on 5 October 2022].

4 Act to Reduce and End Coal-Fired Power Generation (KVBG). URL: https://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&jumpTo=bgbl120s1795.pdf#bgbl %2F%2F*%5B%40attr_id%3D%27bgbl120s1818.pdf%27%5D 1601384424365 [Accesed on 9 December 2022].

5 Ministry of Economic Affairs and Energy (2020): Key components of the German Coal Phase-Out Act. URL: https://www.bmwk.de/Redaktion/DE/Downloads/J-L/kerninhalte-kohleausstiegsgesetz-strukturstaerkungsgesetz.pdf? blob=publicationFile&v=8%20( [Accessed on 9 December 2022].

6 After the authorisation under state aid legislation, the tendering system will be adapted in future which relates to 2027. It is planned that the last tendering round will not take place in 2027 in order to ensure that there is a consistently high level of competition for the tenders.

7 There is no publicly accessible information to calculate the compensation sum.

8 Federal Ministry of Economic Affairs and Energy (2020): Contract under public law to reduce and end electricity generation in Germany from lignite. URL: https://www.bmwk.de/Redaktion/DE/Downloads/M-O/oeffentlich-rechtlicher-vertrag-zur-reduzierung-und-beendigung-der-braunkohleverstromung-entwurf.pdf? blob=publicationFile&v=4 [Accessed on 9 December 2022].

9State Office for Mining, Geology and Natural Resources, Brandenburg (2022): Precautionary agreement. URL: https://lbgr.brandenburg.de/lbgr/de/aktuell/buergerinfor- mationen/vorsorgevereinbarung/# [Accessed on 9 December 2022].

10 Precautionary agreement between LEAG and the Free State of Saxony. URL: https://www.oba.sachsen.de/kohleausstieg-4084.html [Accessed on 9 December 2022].

11 Cf: https://www.leag.de/de/news/details/vorsorgevereinbarung-mit-brandenburg-aktualisiert/ [Accessed on 12 December 2022].

12 Cf: https://www.leag.de/de/news/details/vorsorgevereinbarung-mit-sachsen-aktualisiert [Accessed on 12 December 2022].

13 Structural Strengthening of Coal Regions Act. URL: https://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&jumpTo=bgbl120s1795.pdf#bgbl%2F%2F*%5B%40attr_id%3D%27bgbl120s1795.pdf%27%5D1601384039076 [Accessed on 9 December 2022].

14 Source for the figures mentioned in this section: BMWK (2020): Renewable energies in figures, national and international development in 2020. URL: https://www.erneuerbare-energien.de/EE/Redaktion/DE/Downloads/Berichte/erneuerbare-energien-in-zahlen-2020.html [Accessed on 20 June 2022].

15 Federal Institute for Geosciences and Natural Resources (2020): BGR energy study 2019. URL: https://www.bgr.bund.de/DE/Themen/Energie/Down-loads/energiestudie_2019.pdf? blob=publicationFile&v=6 [Accessed on 9 December 2022].

16 German Geothermal Energy Association (2020): State of research and research needs in geothermal energy. URL: https://www.geothermie.de/fileadmin/user_up- load/Forschung_Papier_2020_A4_20201217_Final_interaktiv.pdf [Accessed on 9 December 2022].

17 On 3 September 2020 the European Commission published a study that posed similar questions and looked at the requirement for critical natural resources for the European Union as a whole. Among other issues this also looks at the status of the renewable energy sector. See here: https:// ec.europa.eu/docsroom/documents/42881 [Accessed on 9 December 2022].

21 For more on this, visit: https://www.netzentwicklungsplan.de/de/netzentwicklungsplaene/netzentwicklungsplan-2030-2019

22 For information of natural resources as defined in the EU critical raw materials list, see: https://ec.europa.eu/growth/sectors/raw-materials/specific-interest/criti- cal_en

23 Overview of lithium projects and deposits: BGR (2021): Germany – Natural Resources Situation 2020, p.55 et seq URL: https://www.bgr. bund.de/DE/Themen/Min_rohstoffe/Downloads/rohsit-2020.html [Accessed on 9 December 2022].

24 Schmidt, (2017): Rohstoffrisikobewertung – Lithium. – DERA Rohstoffinformationen. URL: https://www.bgr.bund.de/DE/Gemeinsames/Produkte/Downloads/DERA_Rohstoffinformationen/rohstoffinformationen-33.pdf? blob=publicationFile&v=2

25For both projects, the responsible authorities have not yet provided any information on the planned start of production, possible deposits and resources. Details on this can be found in the information offered by the companies themselves.

26 BGR (2021): Press release: BGR coordinates project: Research network studies lithium potential in Germany. URL: https://www.bgr.bund.de/DE/Gemeinsames/Oeffentlichkeitsarbeit/Pressemitteilungen/BGR/bgr-2021-10-26_lithi- um-potentiale-germany.html?nn=1544712 [Accessed on 20 September 2022].

27 Sächsisches Staatsministerium für Wirtschaft, Arbeit und Verkehr (2017): Rohstoffstrategie für Sachsen. URL: Rohstoffstrategie für Sachsen – Publikationen – sachsen.de